nToken Returns

nTokens provide all the liquidity to Notional's liquidity pools. This means that nTokens are the counterparty to all fixed rate lends and borrows on Notional's liquidity pools. When a user borrows fixed, nTokens lend fixed. When a user lends fixed, nTokens borrow fixed.

In return for providing liquidity to Notional's fixed rate liquidity pools, nTokens earn returns in three ways:

Interest accrual: nTokens hold their cash in cTokens, and they earn interest from their cTokens. nTokens also hold fCash positions which earn interest if the fCash position is positive, or pay interest if the position is negative.

Transaction Fees: nTokens earn a fee anytime an end user borrows or lends. Transaction fee returns are driven by volume - the more borrowing and lending, the more fees generated.

NOTE Incentives: nToken holders are directly incentivized with Notional’s governance token, the NOTE. nToken holders accrue NOTE rewards proportional to their share of the total nTokens.

Returns example

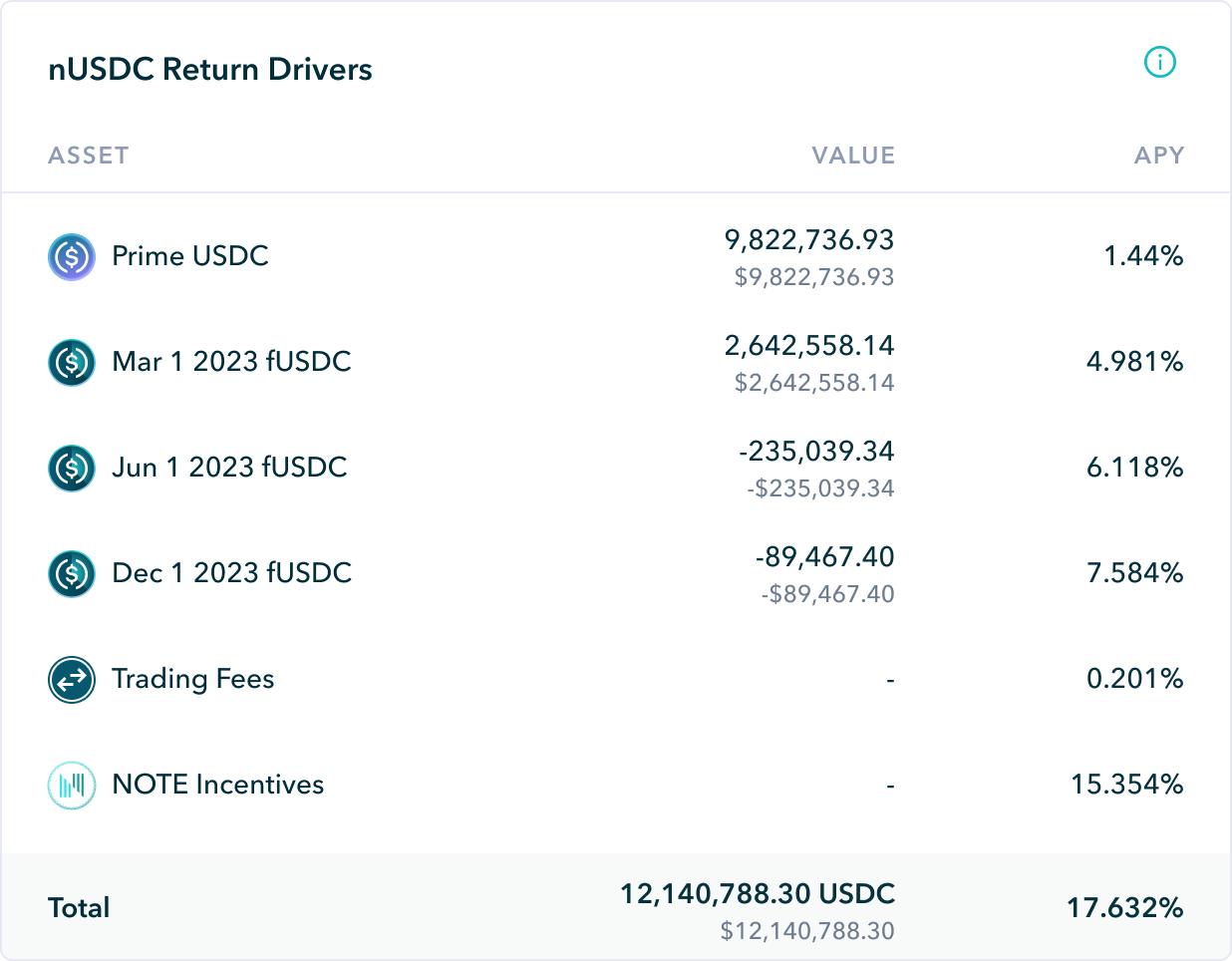

Here is an example breakdown of return drivers for nUSDC.

In this example, most of the nUSDC cash is held in prime USDC which is earning 1.44% APY. nUSDC also has net fCash positions in each maturity. It has a net lending position in the March maturity earning 4.981%, and it has small net borrowing positions in June and December.

The total interest accrual APY in this example is 2.077%. Trading fees are earning 0.201% APY and NOTE incentives are earning 15.354% APY.