Lending

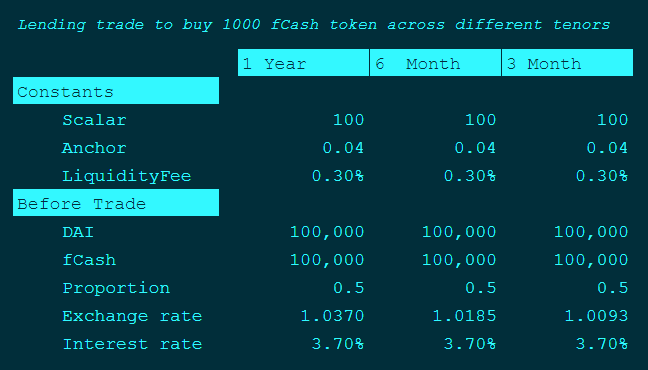

This section will show an example of a lender buying 1000 fDAI from three different liquidity pools. Each liquidity pool has a different maturity. One is a 1-year pool (fDAI maturing in one year), one is a 6-month pool (fDAI maturing in 0.5 years), and the last is a 3-month pool (fDAI maturing in 0.25 years).

Before lending

Here is what the pools look like before the user lends.

Everything is the same except for the exchange rate. This is because the exchange rate between fCash and cash depends on the time to maturity.

Lending

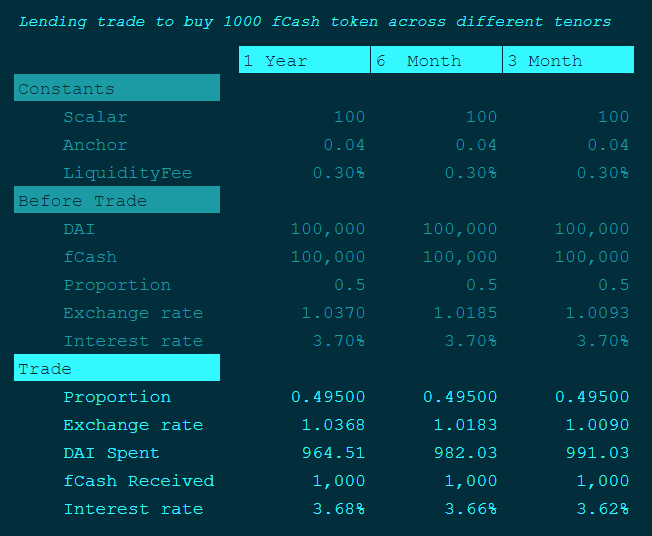

Now let's assume the user purchases 1000 fDAI from each maturity.

It takes less DAI to purchase 1000 fDAI in the 1 year maturity than it does in the 6 month or 3 month maturities. This is because of different DAI/fDAI exchange rates in the different maturities. Also, notice that the interest rate that the lender received isn't exactly the interest rate on the pool before hand. This is due to slippage.

After lending

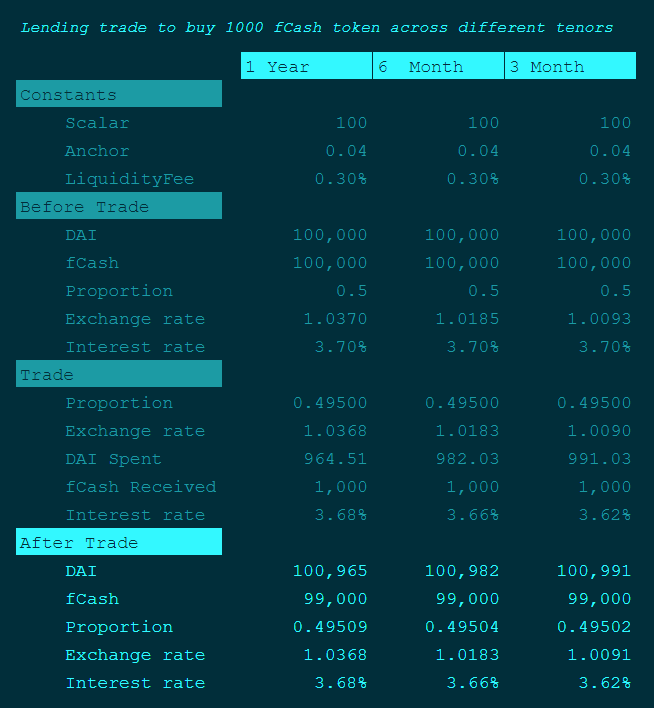

Here is what the pools look like after the lend transactions have occurred.

Notice that the interest rate and proportions on the pools have all decreased as a result of the lending.