FAQs

Important terms

fCash - fCash are transferable tokens that represent a claim on a positive or negative cash flow at a specific point in the future.

nTokens - nTokens are the primary way users provide liquidity to Notional, and are ERC20 assets that are redeemable for a share of Notional’s total liquidity in a given currency across all active maturities.

cTokens - cTokens are interest-bearing assets native to the Compound protocol. cTokens are used within Notional to increase returns for liquidity providers.

Note - NOTE is an ERC-20 token that governs the Notional protocol. NOTE holders can propose, vote on, and implement changes to Notional system parameters and smart contracts.

I want to borrow, but what happens if the price of my collateral changes?

When the price of your collateral changes, your collateralization ratio changes. The minimum collateralization ratio that you need to maintain will vary depending on the asset that you're borrowing and the collateral type you're using. For example, the minimum collateralization ratio for a USDC loan against ETH is 145%. If your collateralization ratio falls below the minimum 145%, you become eligible for liquidation.

During liquidation, a liquidator purchases a portion of an account’s collateral at a discount to the on-chain oracle price and repays some of the liquidated account’s debt. The liquidator can purchase at least 40% of the account's collateral, even if the account is only slightly undercollateralized. Here’s an example:

A borrower deposits 1 ETH as collateral with a ETH/USDC exchange rate of 4,000.

The borrower then borrows 2,000 USDC. Their collateralization ratio is 200% because the value of their collateral is twice the value of their debt. Their liquidation price is 2,900 because at that price their collateral will be worth 145% of their debt.

The ETH/USDC exchange rate falls to 2,800. Their collateralization ratio is now 140% and they are eligible for liquidation.

A liquidator purchases 40% of borrower’s ETH at an 8% discount to the on-chain oracle price and places USDC in their account.

In this example, the liquidator will purchase about 0.4 ETH for about 1,037 USDC. This leaves the borrower with 0.6 ETH collateral, an outstanding debt of 963 USDC, and a collateralization ratio of roughly 175%.

Is there a repayment penalty for exiting my loan early?

You can exit your loan at any time without penalty. When you take out a fixed rate loan you are committing to pay a fixed amount at maturity. If you want to repay your loan early, you still need to repay the fixed amount at maturity, but repayment takes less cash upfront than the fixed amount you owe at maturity. Here's an example:

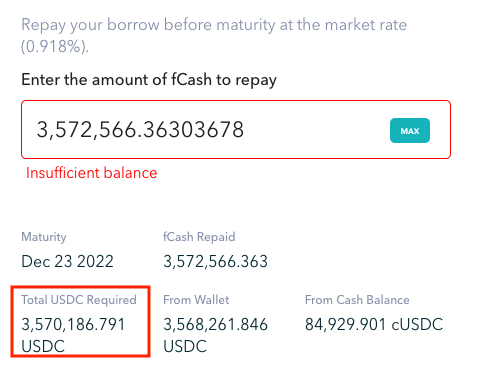

The user owes 3,572,566 USDC at maturity, but the total USDC required to repay that loan is only 3,570,186. This is because repaying a loan is equivalent to lending to the loan's maturity date. The amount that you have to repay upfront depends on the amount of time to maturity and the current interest rate.

In this example, the lend rate that this user would get is 0.918% APY and the maturity is ~2 months away. If lend rates were higher the repayment cost would be lower, and if lend rates were lower the repayment cost would be higher.

Does lending and borrowing happen in one transaction?

In most scenarios, yes. Notional has designed the protocol to minimize user friction as much as possible. You can lend, borrow, provide liquidity, withdraw liquidity or cash into your wallet, repay debts, withdraw loans, or roll assets from one maturity to another, all within a single transaction.

Do I need to do anything to my lend at maturity?

Immediately upon maturity of your loan, you will stop earning the fixed rate, and instead switch to the baseline Compound variable interest rate (assets are automatically wrapped on Notional as cTokens).

Does Notional charge any fees?

Borrowers and lenders pay a small transaction fee that's split between the protocol and the liquidity providers. The rate shown on the Notional UI includes that fee.

What happens if I don't pay back my debt by maturity?

In Notional V2, if you don’t repay the debt you owe to the protocol at maturity, you will be eligible to be forcibly auto-rolled by a third party at a penalty rate. The penalty rate is currently set at 250 basis points, or 2.5%. For example, if you were borrowing at a 6% rate, your new rate will be 8.5% until you pay back your debt, which you are free to do at any time.

You can roll your debt to a future maturity at the prevailing interest rate for that maturity at any time. This means that you don’t need to settle your debts if you do not choose to do so.

Enforcing the repayment of debt at maturity allows Notional to ensure lenders that they will be able to redeem their fCash for the underlying currency that they are entitled to.

Is lending the same thing as providing liquidity?

No. Lenders trade cash for fCash and earn a fixed interest rate. Liquidity providers capitalize Notional’s liquidity pools and earn variable trading fees. Each time a lender lends or a borrower borrows, they pay a transaction fee to liquidity providers in that pool. Notional liquidity pools are similar to Uniswap pools in that there are buyers, sellers, and liquidity providers that facilitate trading. In the case of Notional, buyers and sellers are lenders and borrowers. Liquidity providers facilitate that lending and borrowing and earn transaction fees as compensation.

What is slippage?

Every time a user lends or borrows, the prevailing interest rate on the market changes. The difference between the current interest rate and the interest rate that a user gets on their loan is called slippage. The magnitude of a user's slippage is dependent on the size of their loan relative to the amount of liquidity in the market. A larger loan incurs greater slippage.

What is the best collateral ratio to borrow at?

The collateral ratio you choose determines the likelihood that your collateral gets liquidated. The lower your collateral ratio, the greater your risk of liquidation. Choosing the right collateral ratio for you depends on how much risk you want to take and how actively you plan on managing your positions. Here are a few example personas and the ratios they might choose:

The occasional DeFi user: 250% - 300%+ This user doesn’t want to be bothered keeping a close eye on their collateralization ratio. They don’t check the UI every day and are more concerned with peace of mind rather than optimizing their leverage. Setting a collateralization ratio in this range gives the user confidence that they mostly don’t need to worry about getting liquidated and only need to top up their balances if there is a significant market decline.

The active DeFi user: 180% - 200% This user tracks their positions and uses DeFi products every day but has no automated collateral management system. This user keeps close tabs on their collateral positions but knows that big price moves can happen overnight. Building in a buffer gives this user confidence that their collateral won’t be liquidated before they are able to top up their balances.

The professional: 160% - 170% This user is a professional who manages their collateral positions across DeFi with the help of an automated system. This user wants to get as much leverage as possible out of their collateral. They are comfortable with an aggressive collateral ratio because they know that their system automatically tops up their collateral if they approach the minimum collateralization ratio.

What risks do lenders take?

Lenders face two risks. The first risk is that the protocol could become insolvent because some borrowers have become insolvent. If this were to happen, the protocol might not hold enough cash to pay out lenders. Our robust liquidation protocol and infrastructure minimizes this risk, but it is still possible. In the event that Notional’s liquidation procedure allows a borrower to become insolvent, we have an on-chain reserve fund to help cover any losses that might arise on the platform.

The other risk lenders face is that the smart contracts could get hacked. We take security extremely seriously and take every possible measure to ensure that this won't happen. Our system has been audited and completed formal certification by the industry leaders such as Certora, ABDK, Code Arena & OpenZeppelin.

Is there risk of impermanent loss for liquidity providers?

Yes there is some exposure to impermanent loss for LPs, however, it is mitigated by the fact that LPs deposit cTokens as liquidity instead of the underlying token, which earn the variable Compound lending rate. Check out this page in the docs to get a sense of the return dynamics to providing liquidity in Notional V2.

What does it mean when debts are offset by assets in the same currency?

Notional allows borrowing against cTokens, nTokens or fCash in the same currency. If an account is providing 1,000 USDC worth of liquidity via nTokens (nUSDC) any borrowing in USDC would first be net off against the value of nUSDC collateral. A similar case would apply to accounts holding cUSDC or fUSDC in their portfolio. To learn more see the free collateral section of the documentation.

If the account borrows a small amount of USDC relative to the collateral value of their USDC assets (nUSDC or fUSDC), it may not be at risk of liquidation. In other words, borrowing 100 USDC against 1,000 nUSDC will never be liquidated!

What is interest rate risk?

nTokens and fCash are considered risk assets because their value can change due to changes in interest rates. If an account borrows against nTokens or fCash, it is possible that interest rate changes cause that account to be liquidated.

Because interest rate changes have a smaller effect on collateral value than changes in exchange rates (i.e. the ETH/USDC exchange rate) most borrowers will not be subject to interest rate risk. Interest rate risk will be present for accounts borrowing against nTokens or fCash in the same currency (i.e. borrowing USDC against nUSDC) or in stablecoin pairs (i.e. borrowing DAI against nUSDC).

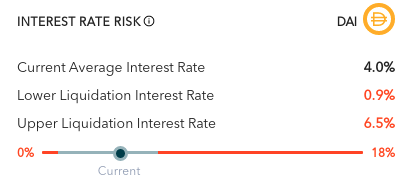

The Notional web application will give an indication of when interest rate risk is present with a warning:

The current average interest rate is an approximation of where all fDAI markets are currently trading. It is an approximate indication of how far away the account is from liquidation. In this example, notice that there are both an upper and lower liquidation interest rate. If the current average interest rate moved to the upper or lower liquidation interest rate, this account would be liquidated. Calculating interest rate risk is approximate and not exact due to the multivariate nature of the risk (multiple fCash markets can effect the outcome).

Also note that the presence of interest rate risk may change if governance changes fCash market parameters. Increased slippage in fCash markets may increase interest rate risk. If you are borrowing against nTokens or fCash make sure that you are monitoring your position via the Notional web app so that you can manage your risk.

To reduce interest rate risk, you can deleverage your position by converting nTokens or fCash to cash and repay your debt.