fCash Maturity

Lender settlement

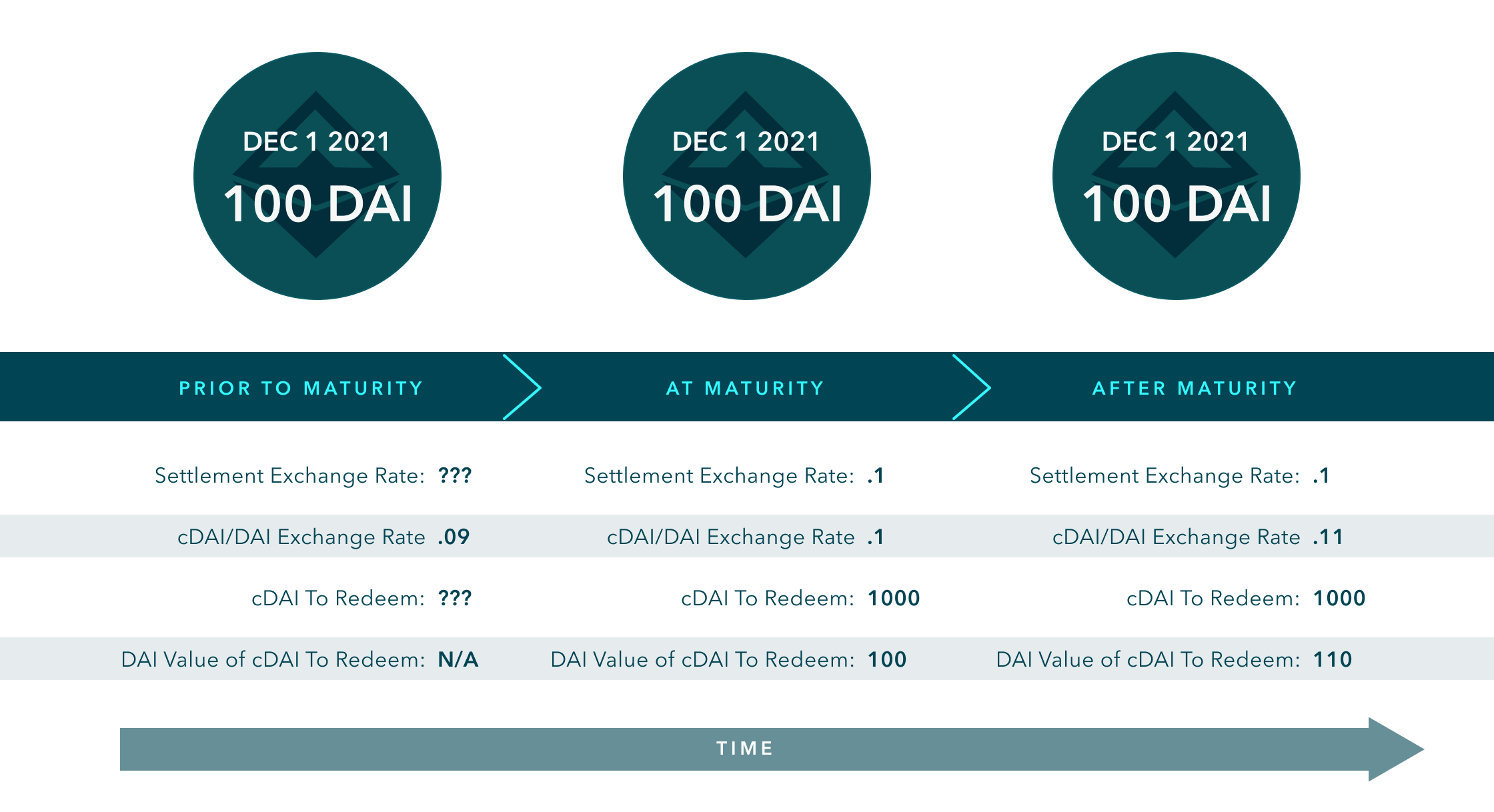

When your fCash reaches maturity, it will automatically convert to cTokens using the fCash/cToken exchange rate at that time. For example, if you have 100 fDAI and the fDAI/cDAI exchange rate at maturity is 0.1 (10 cDAI = 1 DAI), then your fDAI would automatically convert into 1,000 cDAI and start earning the cDAI supply rate.

The fCash/cToken exchange rate is stored on Notional for every maturity - this is called the settlement exchange rate. All fCash at a maturity convert to cTokens at the settlement exchange rate. This means that it doesn't matter if you settle immediately at maturity or if you wait - you will get the same amount of cTokens regardless. This is good because it means you don't lose any interest by not settling your position immediately.

In this example, a lender has 100 fDAI that converts into 1,000 cDAI at maturity using a settlement exchange rate of 0.1. No matter when they come to settle or claim their cash, they will always get 1,000 cDAI. This means that they will always be earning the cDAI lending rate after maturity and the DAI value of their cDAI will grow.

Borrower settlement

As a borrower, you will have a negative fCash balance at maturity which will convert to cTokens at the settlement exchange rate. So if you have -100 fDAI, that will convert into -1,000 cDAI at maturity. This means you will owe Notional 1,000 cDAI, and the DAI value of your debt will increase at the cDAI lending rate after maturity.

If borrowers do not repay their debts by maturity, their debts can be rolled forward to the next maturity three months in the future. When a debt is rolled forward, the borrower is locked into the fixed rate at the next three month maturity + a penalty of 2.5%.

For example, if the interest rate of the next three month maturity is 5%, a borrower who has not repaid their debts will get rolled forward and they will lock in an interest rate of 7.5% (5% + 2.5%) at the next maturity three months in the future.