Entering and Exiting a Vault

Entry

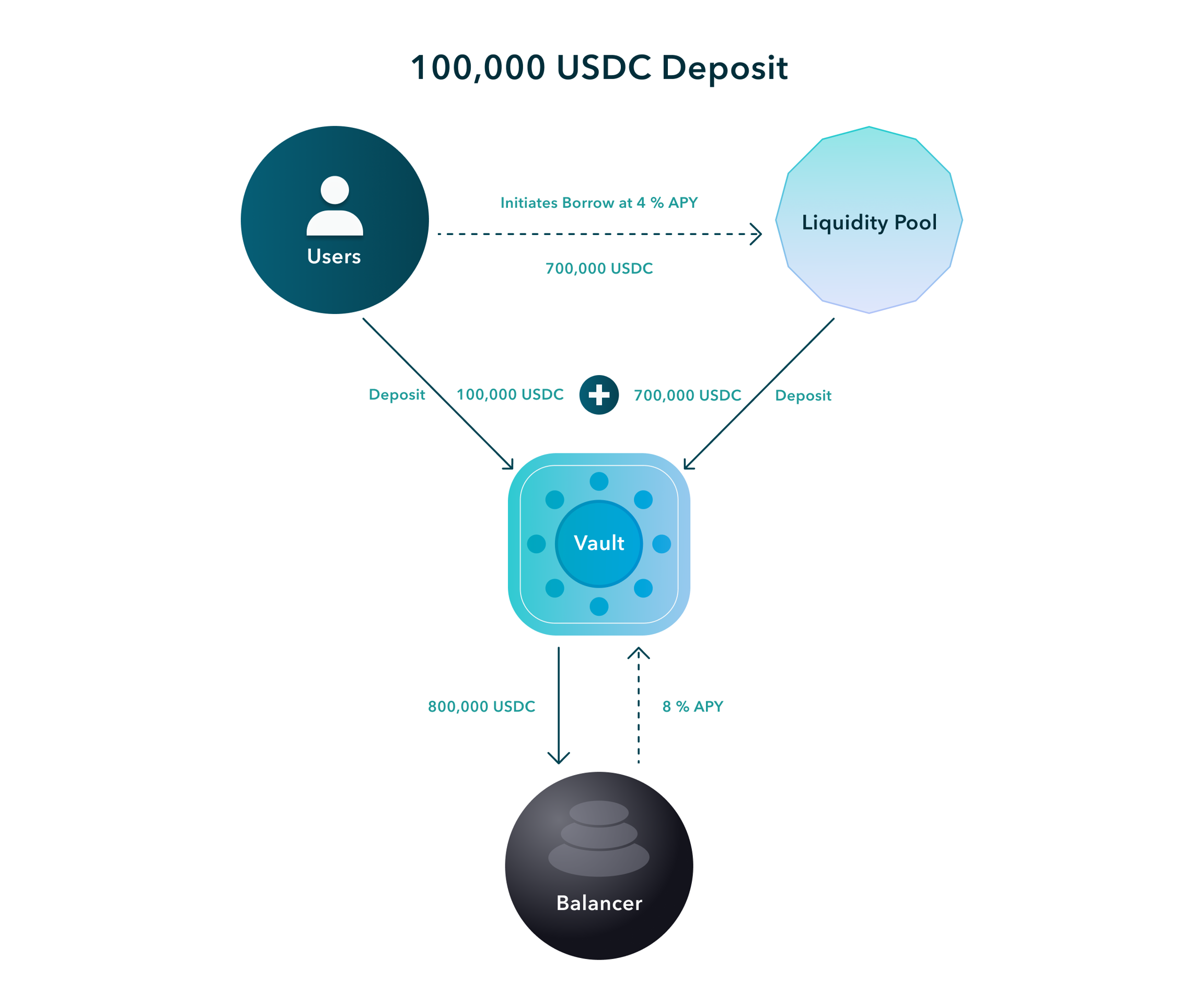

To enter a vault, a user will select the maturity that they want to borrow from, the amount they want to borrow, and the amount they want to deposit. Notional will take the user's deposit, borrow the extra cash from the specified liquidity pool, and deposit the total funds in the vault. The Notional vault controller will record the user's debt and their share of the assets in the vault.

Exit

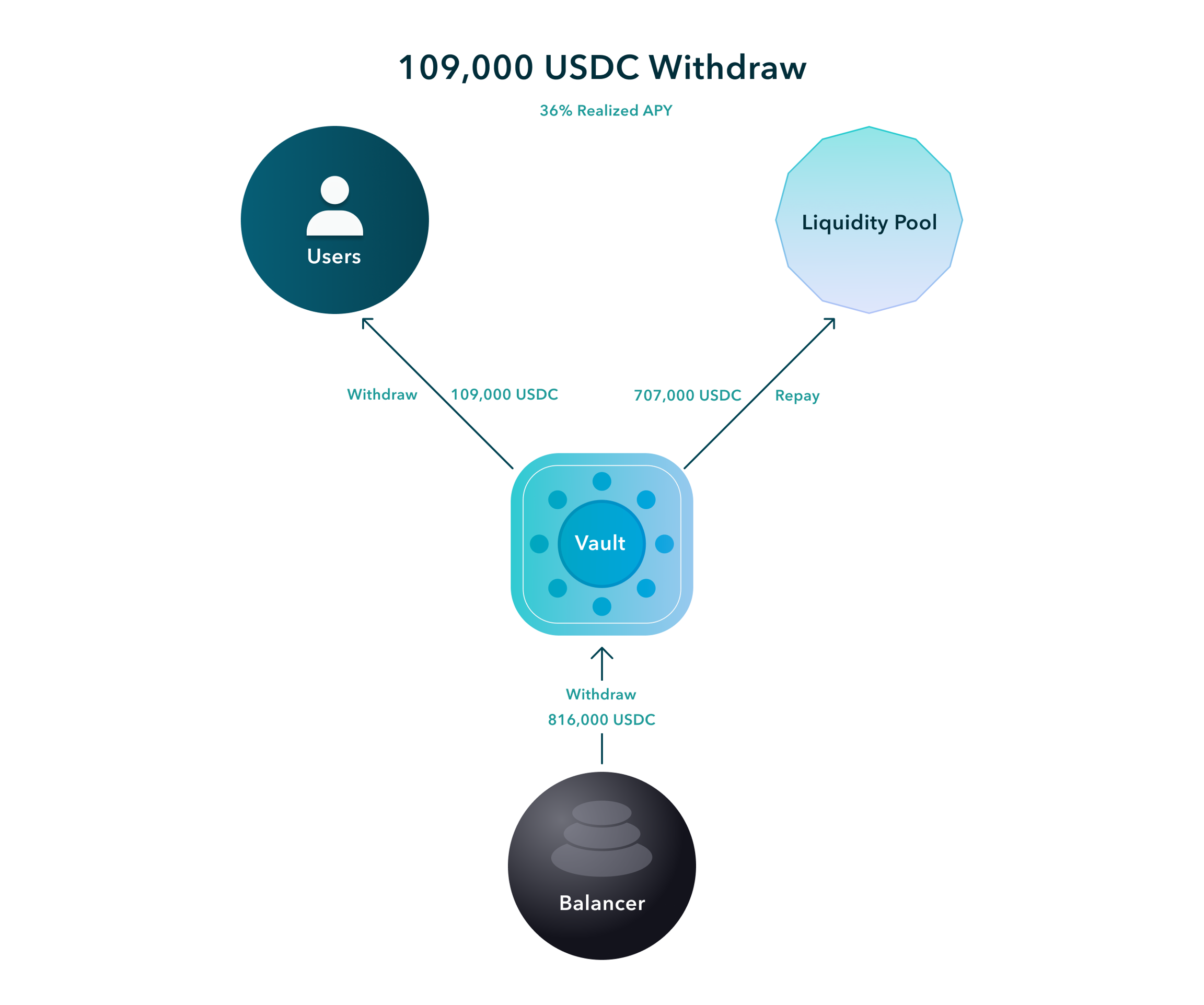

Users can exit a vault at any time, either before or after their debt matures. If the user exits prior to the maturity of their debt, Notional will redeem the user's vault shares, pay off their debt by lending to the specified liquidity pool at the current market rate, and return the excess capital to the user.

If the user waits until after maturity, their position will be settled for them. This involves their vault shares being redeemed and used to pay off their debt as part of the vault-wide settlement process. The capital that remains after the user pays their debts will stay invested in the vault strategy on an un-levered basis and the user can re-lever or withdraw that capital as they please.

Rolling your position

Some users may wish to keep their position in a leveraged vault beyond the maturity of the debt that they initially took out. A user can always wait until settlement and then re-enter the vault, but settlement can include transaction costs. Rolling their position allows the user to extend their levered position in the strategy without paying the costs associated with redeeming and then re-minting their vault shares.

Rolling a strategy vault position works similarly to rolling a normal debt position on Notional. The user will select the maturity they want to extend their debt to, Notional will borrow from that maturity and then use the borrowed cash to pay off the user's debt at the initial maturity. The only difference a user experiences when rolling a levered vault debt compared to a normal debt is that the user must roll their entire debt in one transaction - users can't roll a strategy vault position over multiple transactions.