Providing Liquidity

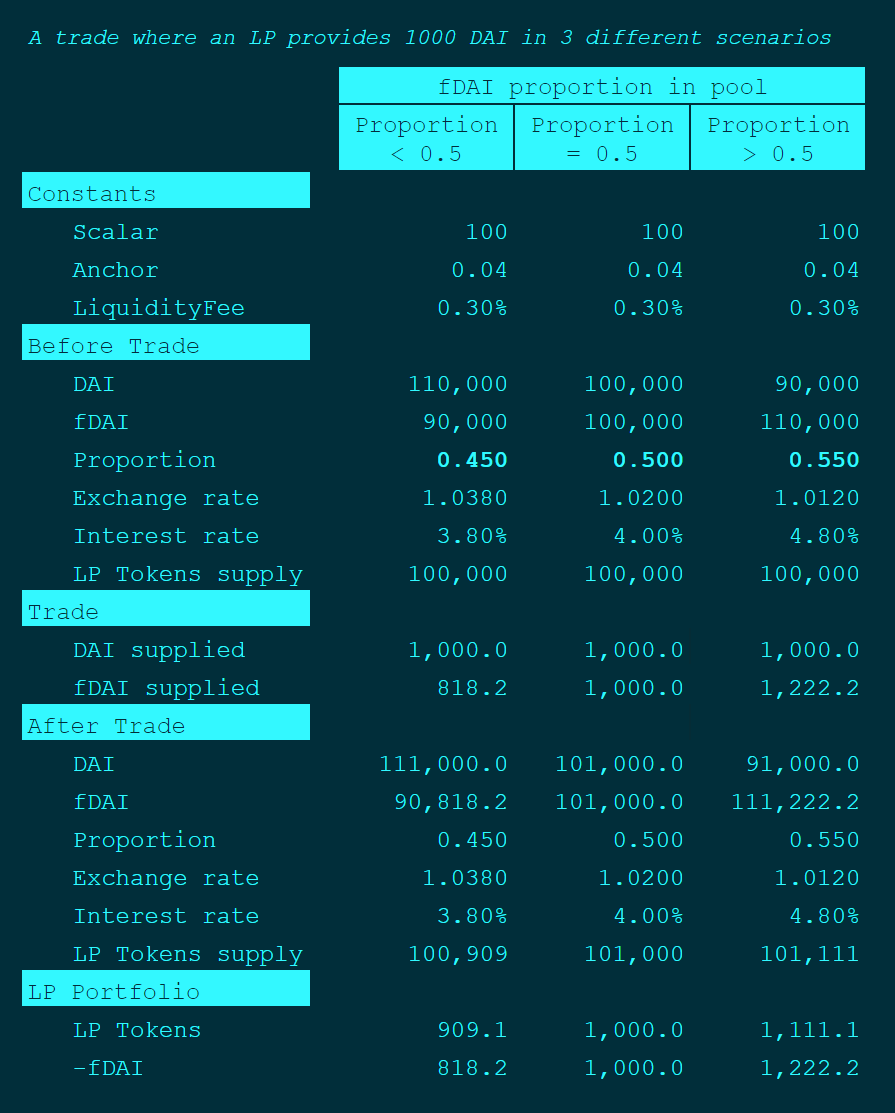

This section will show an example of an LP providing 1000 DAI as liquidity into a single liquidity pool. Since the amount of fDAI the LP needs to mint depends on the liquidity pool's proportion, the example depicts 3 scenarios:

When pool proportion is shifted towards DAI (more DAI than fDAI in the pool)

When pool proportion is balanced (amount of DAI = amount of fDAI)

When pool proportion is shifted towards fDAI (less DAI than fDAI in the pool)

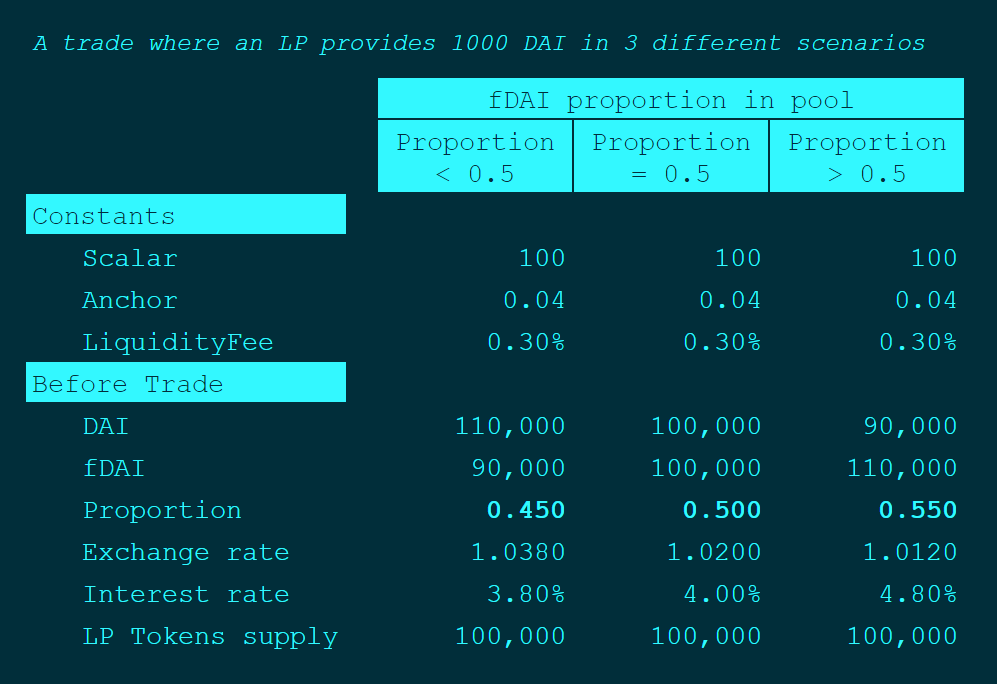

Before the deposit

Here's what the liquidity pool looks like in each scenario before the LP deposits additional liquidity.

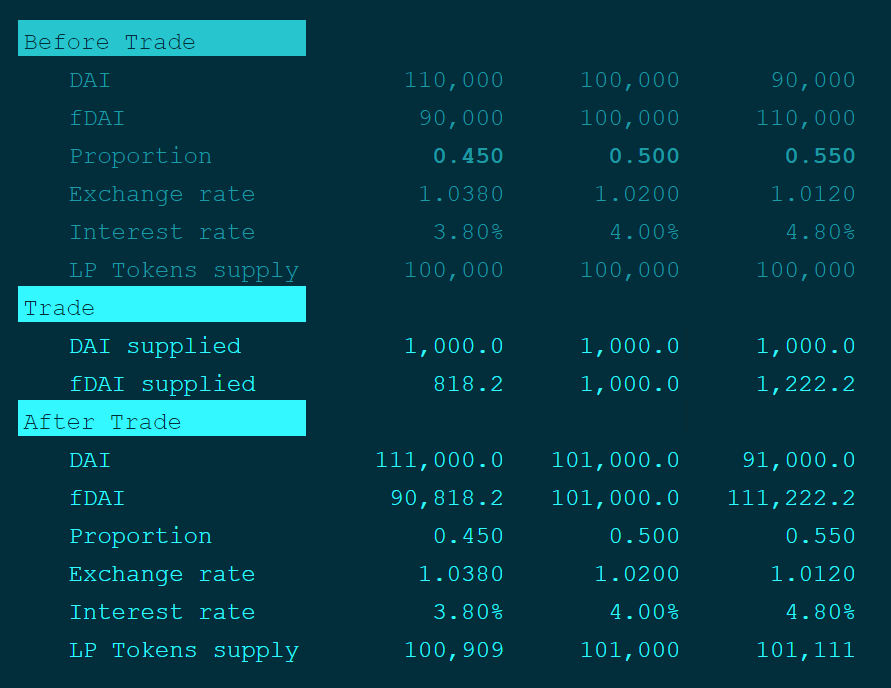

To provide liquidity with 1000 DAI the LP must mint +fDAI and -fDAI. After minting, they can use the +fDAI to pair it with DAI and provide liquidity.

After the deposit

The quantity of +/-fDAI to be minted is computed based on the current balance of funds in the pool, i.e. the proportion. Notice that the +/-fDAI minted (denoted by fDAI supplied in the screenshot) is less in the pool where the proportion of fDAI is lower and vice-versa.

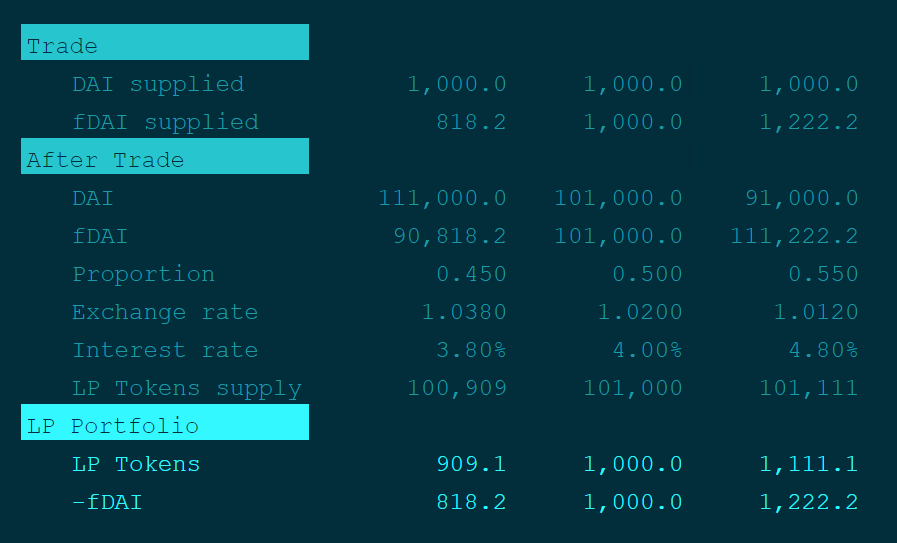

LP portfolio

After the execution of the deposit, the LP's portfolio consists of the liquidity tokens and -fDAI. A crucial thing to notice is that the exchange rates and the interest rates never change when LPs provide liquidity.

Whole example