NOTE Staking

Staked NOTE (sNOTE) gives NOTE holders the opportunity to earn yield on their NOTE while contributing to the security of the Notional protocol and providing liquidity for the NOTE token.

Staking NOTE

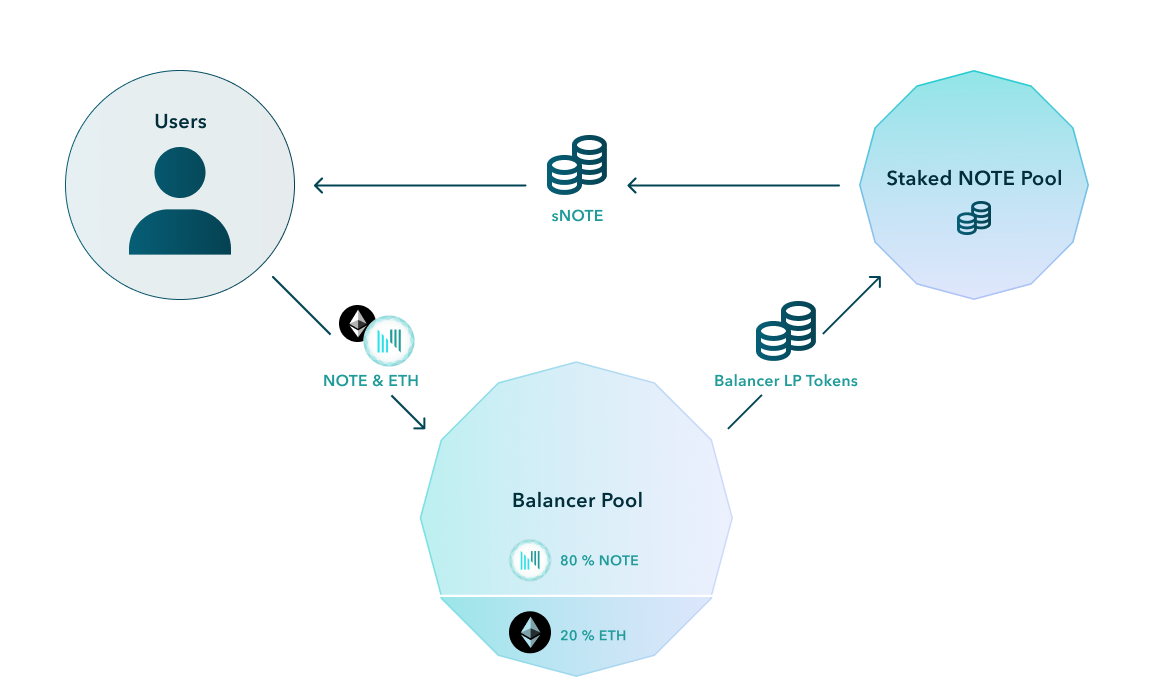

In order to stake NOTE, users convert their NOTE into 80/20 NOTE/WETH Balancer LP tokens and receive sNOTE in return.

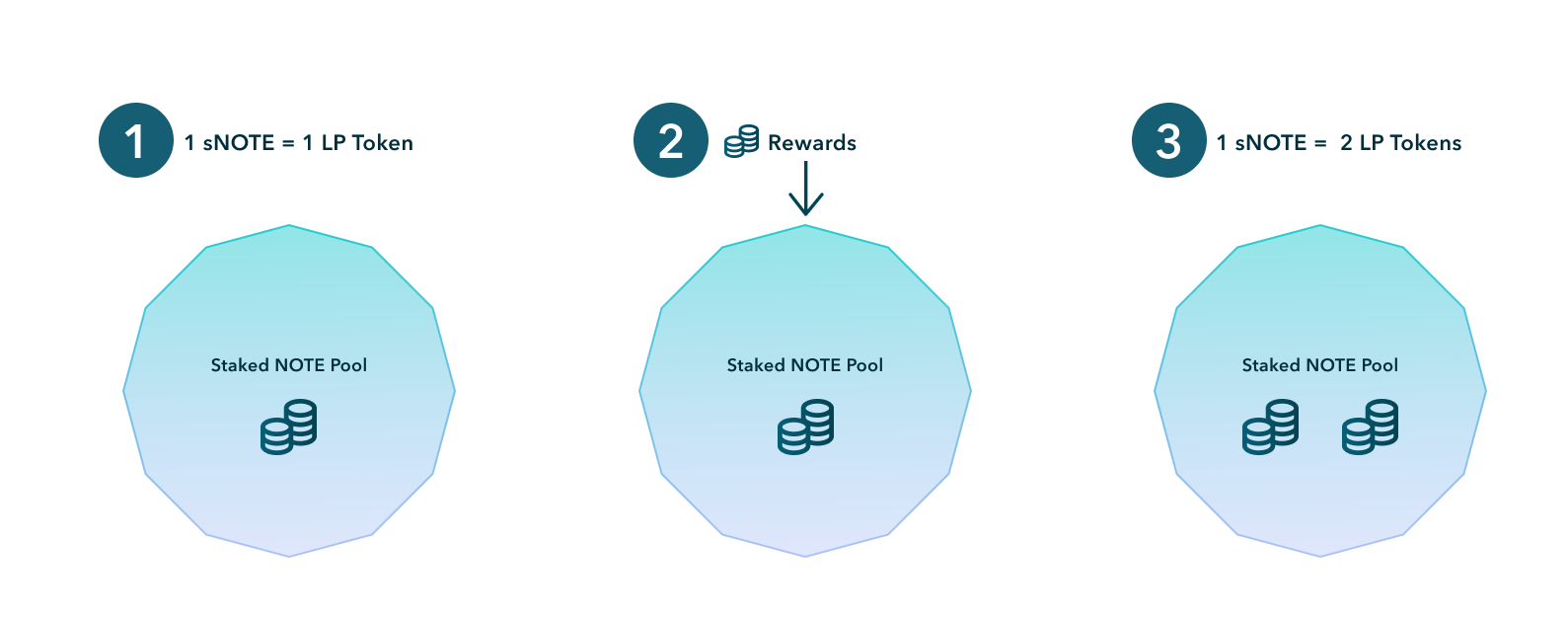

sNOTE is redeemable at any time for a proportional share of the LP tokens in the pool. As the pool accrues rewards, each sNOTE is redeemable for an ever-increasing number of LP tokens.

sNOTE Rewards

sNOTE rewards accrue in the form of Balancer LP tokens. This means that, absent any sNOTE redemptions, the sNOTE pool will hold an increasing number of LP tokens. As the pool accrues rewards, each sNOTE is redeemable for an ever-increasing number of LP tokens.

Rewards come from two sources:

Protocol revenue re-investments. Notional earns transaction fees each time a user lends or borrows and COMP incentives due to the protocol's integration with Compound. Currently, Notional's transaction fees are held in the protocol's reserve and the COMP incentives earned are converted into LP tokens to reward sNOTE holders.

Additional incentives. The Notional community may choose to provide additional incentives to encourage NOTE staking. Currently, the community allocates 30,000 NOTE per week in additional incentives to sNOTE holders.

Calculating sNOTE Returns

To calculate sNOTE returns, users need to balance the rewards and trading fees received against the IL of holding 80/20 NOTE/WETH LP tokens. The 80/20 pool minimizes IL for LP token holders, but if the price of NOTE moves a lot in a very short period of time, it can still be significant.

Here is a step-by-step guide to determining the returns to holding sNOTE vs holding NOTE outright in different market conditions.

Calculate the total reward APY. The total reward APY is the sum of the re-investment APY, the additional incentive APY, and the trading fee APY.

Choose a holding period. How long do you plan to hold your NOTE? 6 months? 1 year? Etc.

Choose a NOTE/WETH price change. Do you expect NOTE to 5x vs ETH? 10x? Etc.

Calculate total reward percentage.

totalRewardPercentage = totalRewardAPY * (holdingPeriod/year)Calculate IL.

valueOfPool = (1 + 1 * (priceChange / 100)) ^ (0.8) assetValueIfHeld = (1 + 1 * (priceChange / 100)) impermanentLoss = ((valueOfPool / assetValueIfHeld) - 1) * 100Calculate the simple return.

return = (1 + totalRewardPercentage) * (1 - IL) - 1Calculate the annualized return.

annualizedReturn = return * (year/holdingPeriod)

Example Calculation:

totalRewardApy = 100%

reInvestmentApy = 50%

additionalIncentiveApy = 40%

tradingFeeApy = 10%

holdingPeriod = 6 months

NOTE/WETH price change = +200%

totalRewardPercentage = 100% * 0.5 = 50%

IL:

valueOfPool = (1 + 1 * (200 / 100)) ^ (0.8) = 2.408 assetValueIfHeld = (1 + 1 * (200 / 100)) = 3 impermanentLoss = ((2.408 / 3) - 1) * 100 = 19.7%return = 1.5 * 0.803 = +20.45%

annualizedReturn = +20.45% * 2 = +40.9%

Redeeming sNOTE

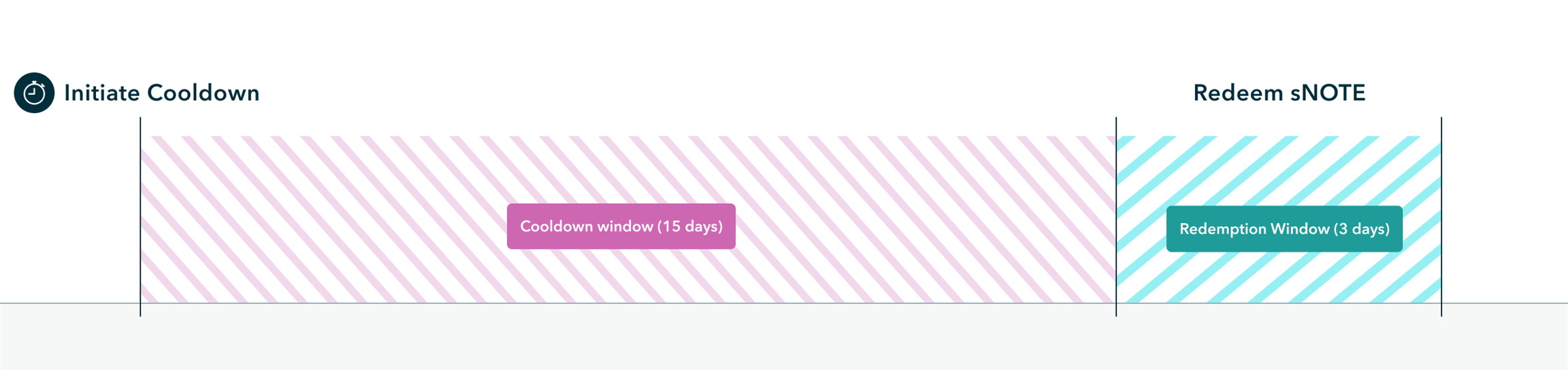

sNOTE is only redeemable after the user initiates a cooldown period of 15 days. The cooldown period ensures that sNOTE holders can't immediately redeem upon a collateral shortfall event before Notional governors take action.

After the 15 day cooldown period, the user can redeem their sNOTE at any time during the 3 day redemption window.

If the sNOTE is not redeemed during the redemption window, the user will need to re-initiate the redemption sequence and wait out the 15 day cooldown again.

Collateral Shortfall Events

A collateral shortfall is a scenario where Notional no longer holds the necessary collateral to make good on its liabilities to lenders and liquidity providers. Collateral shortfalls are critical events that should never happen if the system is working properly. Notional could experience a collateral shortfall for two reasons:

Smart contract hack. The risk that a hacker exploits a vulnerability or design flaw in the Notional smart contracts that was missed in auditing and testing.

Liquidation failure. The risk that the price of collateral assets held on Notional fall dramatically and liquidators are unable to liquidate accounts that have borrowed against that collateral before the accounts become insolvent. Minor liquidation failures will be covered by Notional's reserve funds. Only major liquidation failures would lead to collateral shortfalls.

In the event of a collateral shortfall, NOTE token holders can hold an on-chain vote to take 50% of the assets held in the sNOTE pool and use them to recapitalize the system. In this event, sNOTE holders would bear a loss of up to 50% of their assets.