Redeeming nTokens

nTokens are always redeemable for a proportional share of the assets in the nToken account, including cTokens and fCash.

But usually, users don't want the fCash when they redeem. They want to redeem directly to underlying. To do this, users will redeem their nTokens, get their share of the fCash, and then sell that fCash on the liquidity pools to convert fully to cash. The Notional UI does all this for the user in a single transaction.

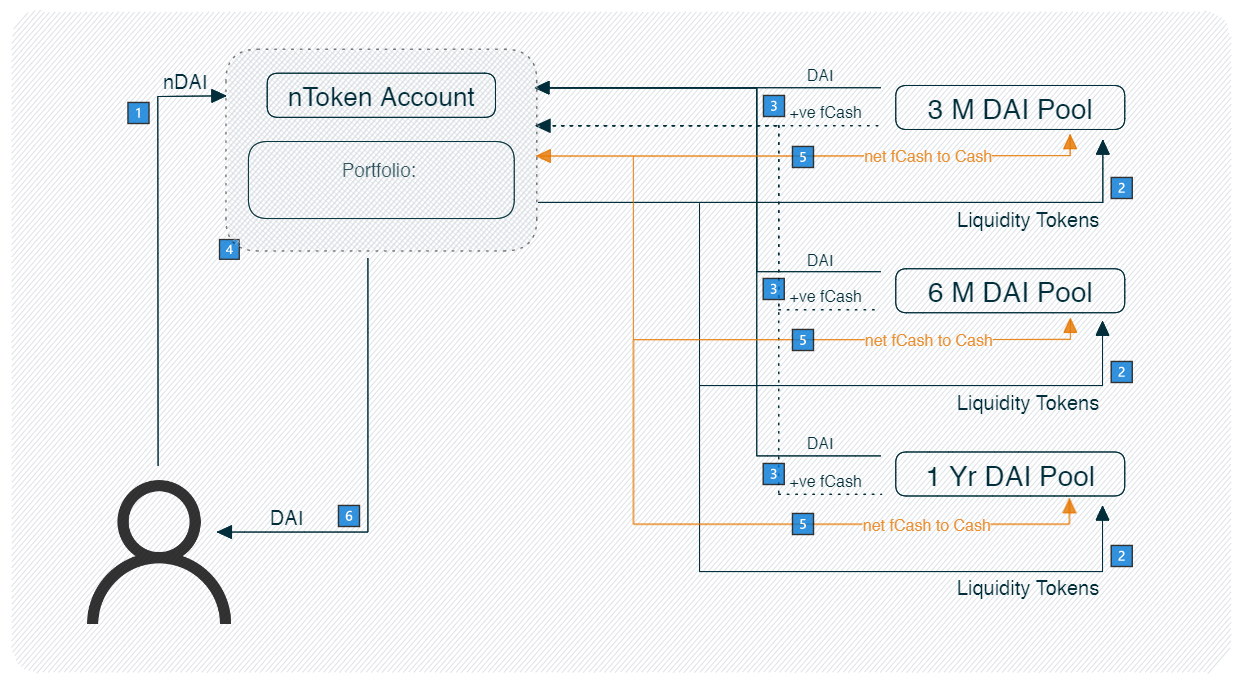

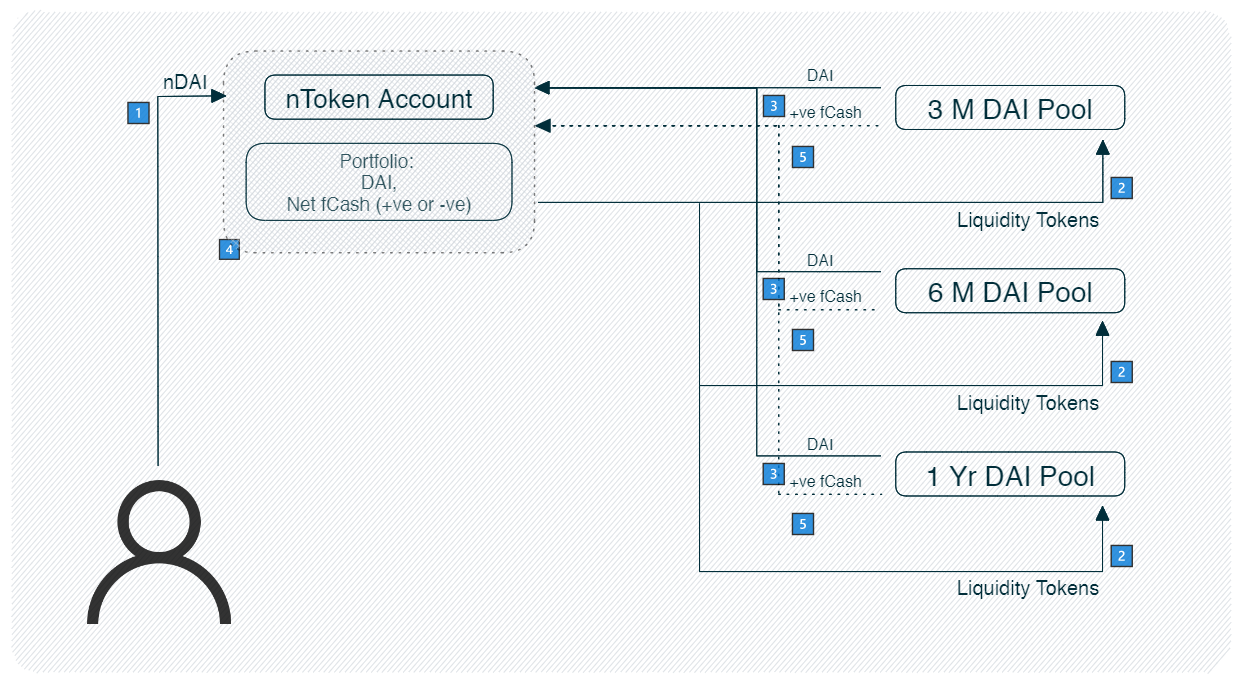

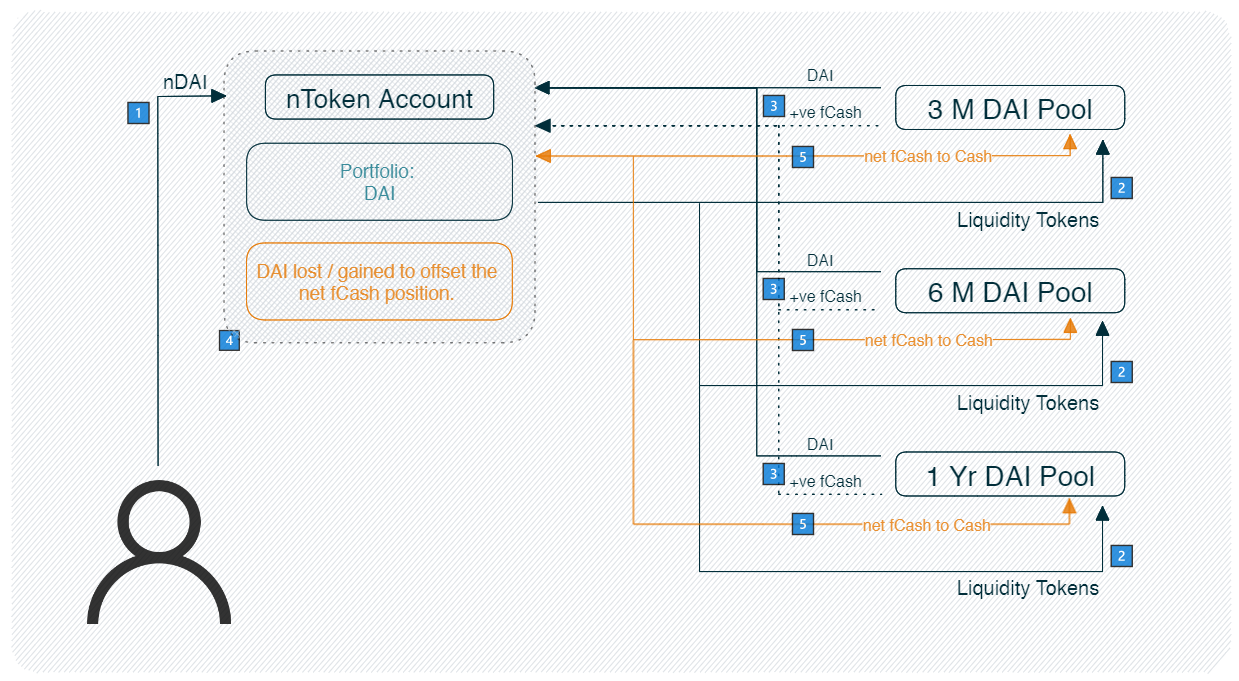

Here is a detailed flow of redeeming nTokens directly to cash.

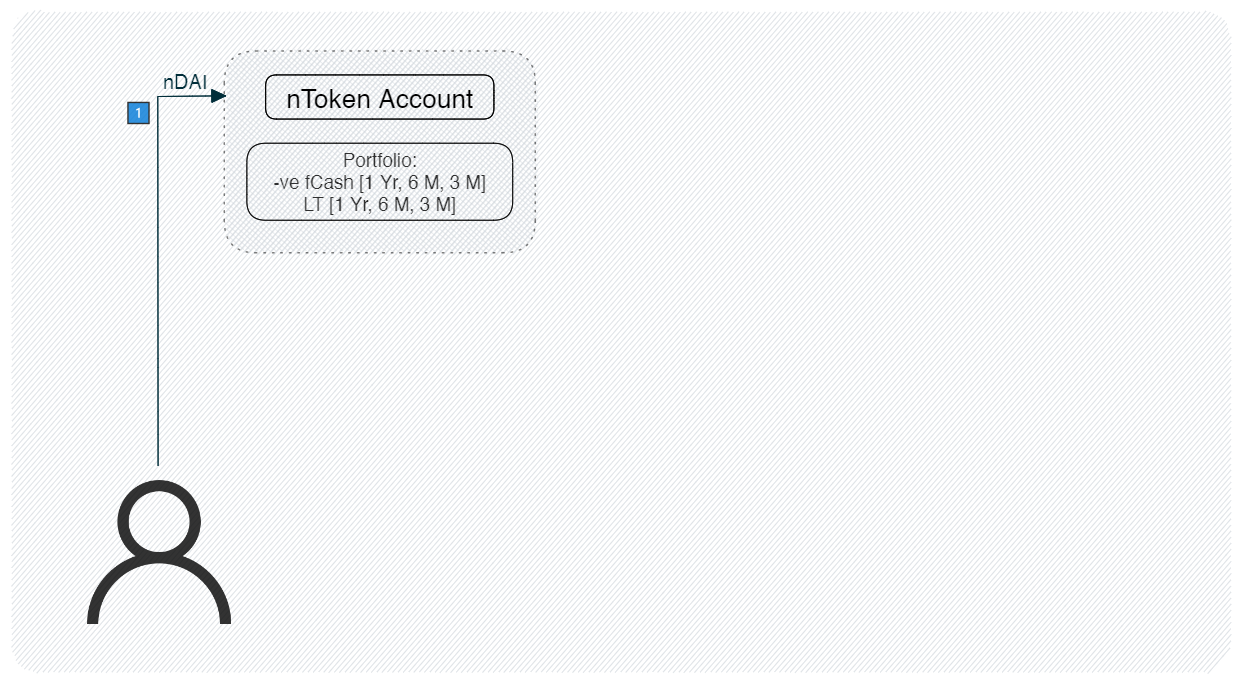

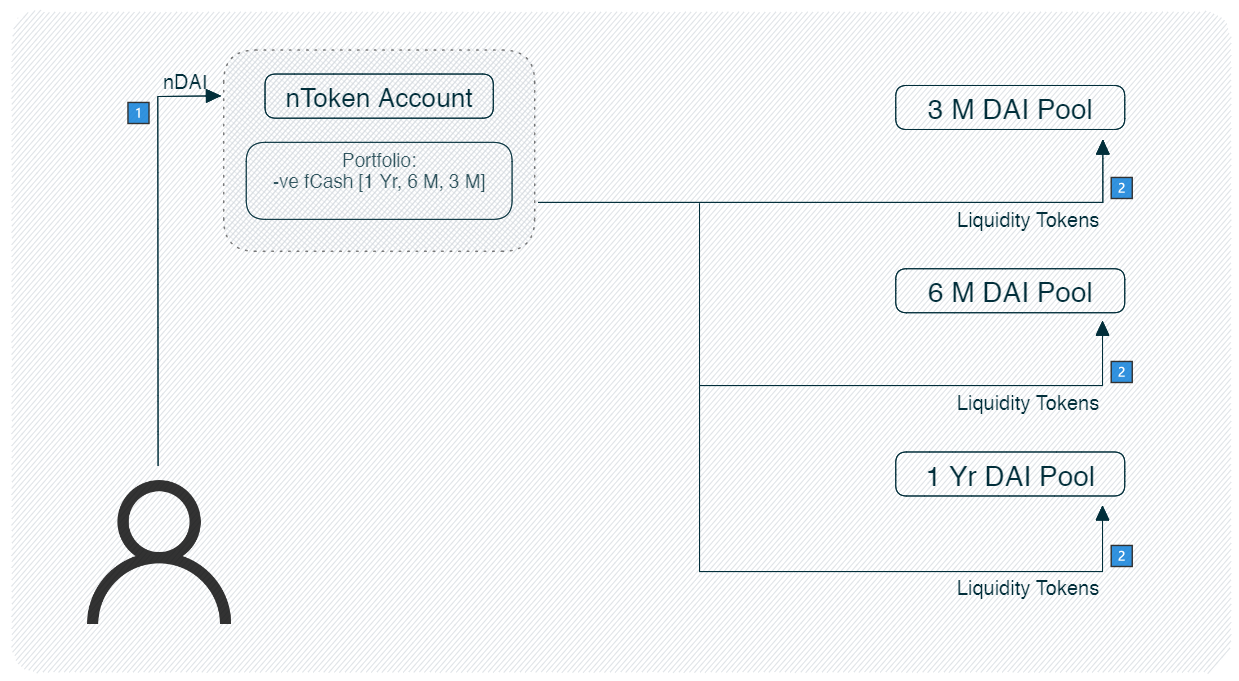

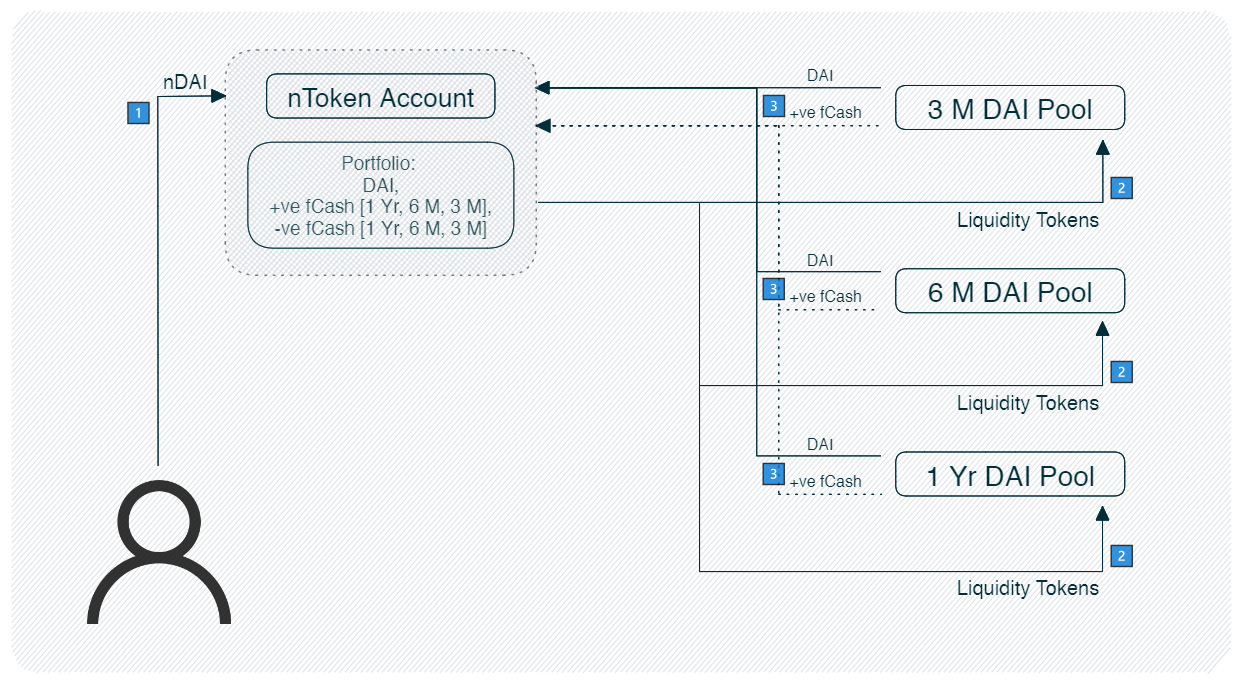

When a user redeems the nToken portfolio will hold liquidity tokens and negative fCash. The first step to redeeming is for the user to give up their nTokens.

The nToken account then redeems a proportional share of its liquidity tokens.

When the nToken account redeems its liquidity tokens, it will receive cash and fCash.

The amount of fCash the nToken pulls out of the liquidity pools is almost always different than a proportional amount of the negative fCash position it started with because interest rates will have moved and shifted the proportion of cash to fCash in the liquidity pools. This means that the user has a claim on a net fCash position that can be positive or negative.

To redeem down to underlying, the user needs to trade this net fCash on the liquidity pool. If the net fCash position is positive, the user will receive more cash. If it's negative the user will get less cash.

Now Notional has converted all of the users assets to cash and returns that cash to their wallet.