What is fCash

fCash tokens are similar to zero-coupon bonds. They are defined by a currency type and a maturity date. At maturity, fCash can be redeemed on Notional for its currency type. Any time before maturity, fCash can be transferred or traded.

For example, December 1st 2021 fDAI is an fCash token. This fCash token is transferable, and tradable. And At maturity (December 1st, 2021), 1 December 1st 2021 fDAI token can be redeemed for 1 DAI on Notional. In other words, fCash tokens represent specific amounts of currency at specific future dates.

What is fCash good for?

fCash is the core innovation that powers fixed rate borrowing and lending on Notional. fCash allows the protocol to keep track of lenders claims on assets in the future and borrowers obligations to repay their debts.

Let's use an example from traditional finance - a bond issuance. In a bond issuance, a borrower asks lenders to lend them money. In return, the borrower commits to paying back the debt + a fixed amount of interest at a specific date in the future.

In this example, the borrower has a fixed obligation at maturity (debt + interest) and the lender has a fixed asset at maturity (principal + interest). fCash is the tool that allows Notional to define and track these assets and obligations.

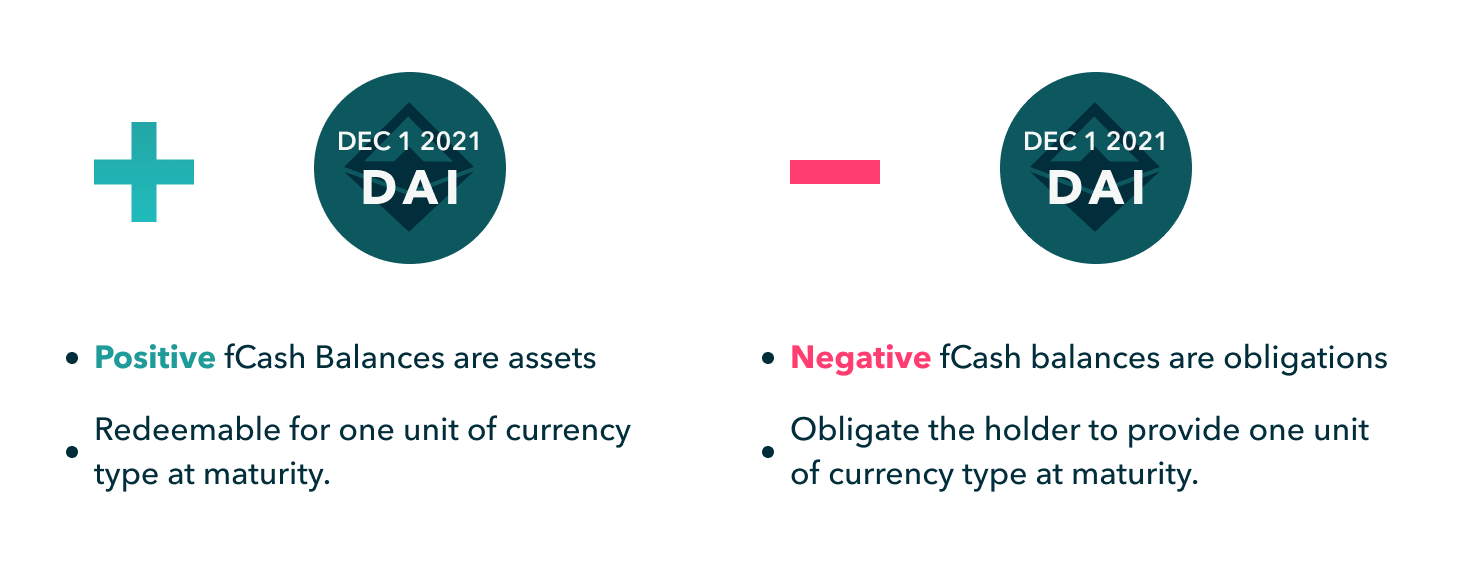

Positive fCash balances are assets held by lenders, and negative fCash balances are obligations held by borrowers.