fCash Maturity

Lender settlement

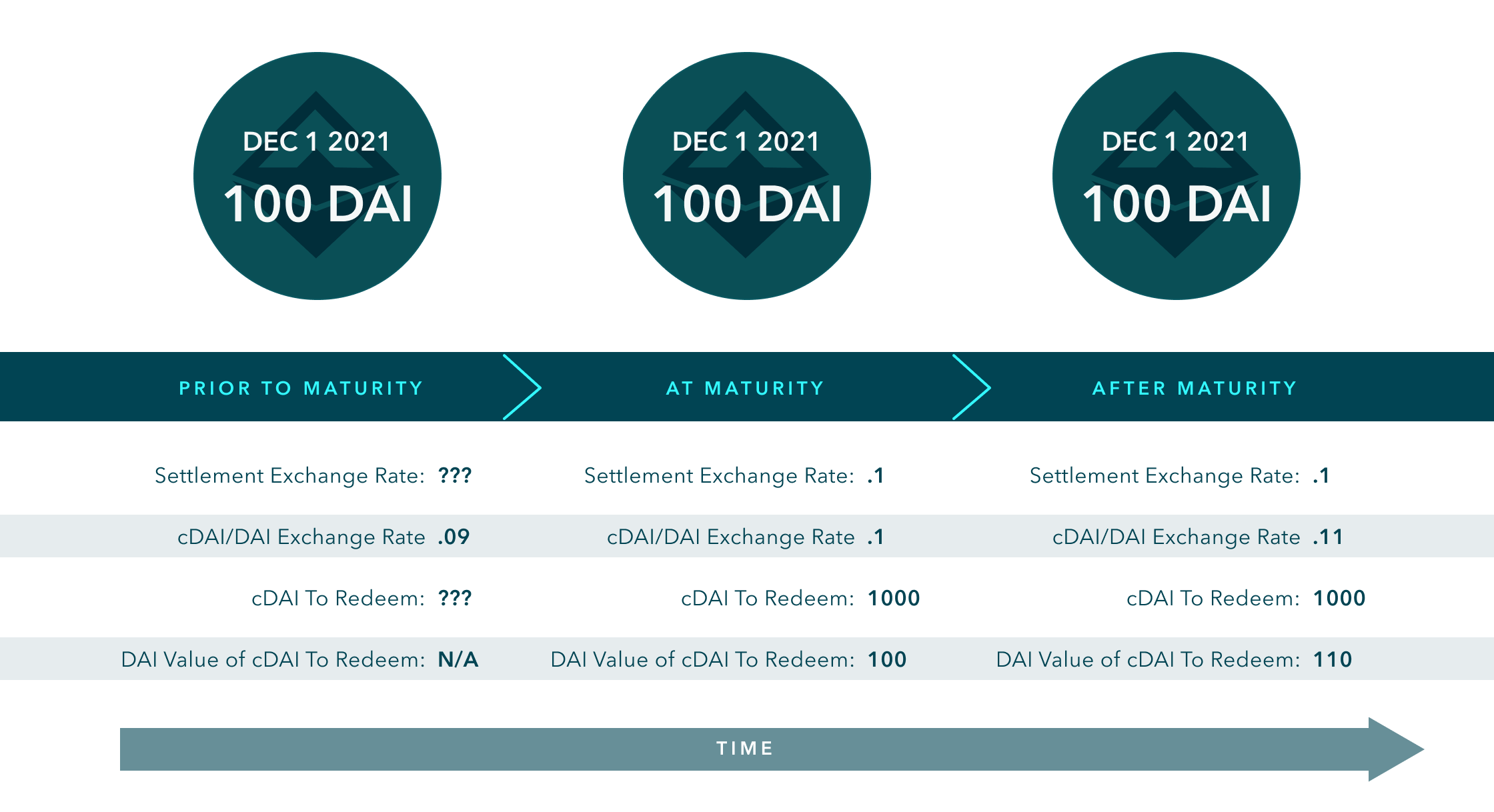

When your fCash reaches maturity, it will automatically convert to Prime Cash using the fCash / Prime Cash exchange rate at that time. For example, if you have 100 fDAI and the fDAI / Prime DAI exchange rate at maturity is 0.1 (10 Prime DAI = 1 DAI), then your fDAI would automatically convert into 1,000 Prime DAI and start earning the Prime DAI lending rate.

The fCash / Prime Cash exchange rate is stored on Notional for every maturity - this is called the settlement exchange rate. All fCash at a maturity convert to Prime Cash at the settlement exchange rate. This means that it doesn't matter if you settle immediately at maturity or if you wait - you will get the same amount of Prime Cash regardless. This is good because it means you don't lose any interest by not settling your position immediately.

In this example, a lender has 100 fDAI that converts into 1,000 Prime DAI at maturity using a settlement exchange rate of 0.1. No matter when they come to settle or claim their cash, they will always get 1,000 Prime DAI. This means that they will always be earning the Prime DAI lending rate after maturity and the DAI value of their Prime DAI will grow.

Borrower settlement

As a borrower, you will have a negative fCash balance at maturity which will convert to Prime Cash Debt at the settlement exchange rate. So if you have -100 fDAI, that will convert into -1,000 Prime DAI Debt at maturity. This means you will owe Notional 1,000 Prime DAI, and the DAI value of your debt will increase at the Prime DAI borrowing rate after maturity.